|

Let’s

Talk HOT Off the Press…

3Q

Prices Hold Steady with Inventory on the Rise

Naples,

Fla. (October

20, 2016) - The Naples Area Board of REALTORS®

(NABOR®) released its Third

Quarter 2016 Market Report, which tracks

home listings and sales within Collier

County (excluding Marco Island),

and it showed overall inventory increased 40

percent with little change

in median closed prices. In fact, as reflected in

the report, the overall

median closed price for homes on the market increased

only 4 percent

to $312,000 in the 3Q of 2016 from $300,000 in the 3Q of 2015.

This

was predominately driven by a 9 percent increase in the $300,000

and below

price category. Comparatively, all other price categories

saw a zero or

negative price adjustment.

Upon

reviewing the report, NABOR® President and Broker Associate

with Berkshire

Hathaway Home Services Florida Realty Rick Fioretti

said, "a quick

analysis of price behavior since December of 2015

hows median closed prices

leveled out." Several broker experts

agreed with Fioretti, adding that the

pricing trend is a natural reaction

to the increase in inventory.

"I

think we're seeing the completion of a cycle that began in 2013," said

Cindy Carroll, SRA, with the real estate appraisal and consultancy firm

Carroll

& Carroll, Inc. "Prices have remained relatively stable for over a

year, and now I'm noticing more competitive value-based pricing as the

supply increases."

Carroll

remarked that her business encounters a small herd of listings

that are still

not moving, and believes ongoing increases in inventory

over the next six

months will require these sellers to adjust their value

perceptions. "The

list to sale price ratio is shrinking and this needs to

continue if we want to

compete with new home construction."

"If

it's overpriced, then the property sits," said Dominic Pallini, Broker at

Vanderbilt Realty, who went on to say that days on market decreased

12 percent

in the $2 million and above price category, but overall, there

was a 10 percent

increase in days on market. "Pricing is critical now

more than ever."

While

both pending and closed sales decreased 14 percent (quarter over quarter),

inventory continued to rise in all areas of Collier County during the 3Q of

2016.

Overall, inventory rose 40 percent to 5,044 homes in the 3Q of 2016 from

3,606

homes in the 3Q of 2015; with a marked increase in Central Naples, which

rose

49 percent to 608 homes in the 3Q of 2016 from 408 homes in the 3Q of

2015.

Inventory

increases in the condominium market were also remarkable during the

third

quarter of 2016. This home type experienced a 53 percent increase in

inventory

to 2,375 condominiums in the 3Q of 2016 from 1,557 condominiums

in the 3Q of

2015.

The NABOR®

3Q 2016 Market Report provides comparisons of single-family

home and

condominium sales (via the Southwest Florida MLS), price ranges,

and geographic

segmentation and includes an overall market summary.

The NABOR® 3Q 2016 sales

statistics are presented in chart format, including

these overall

(single-family and condominium) findings:

"Only

23 percent of homes for sale under $300,000 are single-family

residences,"

said Brenda Fioretti, Managing Broker at Berkshire Hathaway

HomeServices

Florida Realty. "When it's priced right, it sells."

NABOR®

also released its September 2016 Market Report, which showed

activity in

September 2016 compared to activity in September 2015 was a mixed

bag. For

example, while overall pending and closed sales decreased 12 and

19 percent,

respectively, median closed prices held steady or decreased in

73 percent of

the market in September. In fact, median closed prices for all

homes above

$500,000 decreased, with a 12 percent decrease occurring in

the $2 million and

over price category.

"While

this year's summer activity at the high end was no match to last year's

'banner

year' pace, we have started to experience a slight uptick in interest and

inquiries this month when compared to last month," said Richard

Prebish, II,

Broker Associate at William Raveis Real Estate. "I

anticipate there will be

some more great opportunities at reasonable prices

being introduced to the

high end marketplace in the coming months."

The NABOR®

September 2016 sales statistics are also presented in

chart format, including

these overall (single-family and condominium) findings:

Michelle J. DeNomme, REALTOR, GRI

Cellular Phone I 239.404.7787

E-Mail : Michelle@NaplesHomeSweetHome.com

Berkshire Hathaway HomeServices Florida Realty

Office: 239.659.2400

E-Fax Number: 239.236.5550

Website: www.NaplesHomeSweetHome.com

Blog Page: http://michelledenomme.blogspot.com

Twitter Me: DeNommeRealtor

The Naples Area Board

of REALTORS® (NABOR®) is an established organization (Chartered in 1949) whose

members have a positive and progressive impact on the Naples Community. NABOR®

is a local board of REALTORS® and real estate professionals with a legacy of

nearly 60 years serving 5,000 plus members. NABOR® is a member of the Florida

Realtors and the National Association of REALTORS®, which is the largest

association in the United States with more than 1.3 million members and over

1,400 local board of REALTORS® nationwide. NABOR® is structured to provide

programs and services to its membership through various committees and the

NABOR® Board of Directors, all of whose members are non-paid volunteers.

The term REALTOR® is a

registered collective membership mark which identifies a real estate professional

who is a member of the National Association of REALTORS® and who subscribe to

its strict Code of Ethics.

|

Thursday, October 20, 2016

Friday, October 14, 2016

Let's Talk... Hot off the Press!

ATTOM: The foreclosure crisis is over

IRVINE, Calif. – Oct. 13, 2016 – According to ATTOM Data Solutions, the foreclosure crisis is over.

ATTOM released its September and Q3 2016 U.S. Foreclosure Market Report, which includes default notices, scheduled auctions or bank repossessions. In September, foreclosures dropped 13 percent month-to-month and 24 percent year-to-year to hit their lowest level in over a decade – since December 2005.

"Foreclosure activity has been on a steady slide downward over the past six years, finally dropping back below pre-crisis levels in September," says Daren Blomquist, senior vice president at ATTOM. "While we've know that the national foreclosure problem has been dying a long, slow death for quite some time, the final nail in the coffin of the foreclosure crisis is the year-over-year decrease in the average foreclosure timeline nationwide that we saw in Q3 2016 – the first time that's happened since we began tracking foreclosure timelines in Q1 2007.

Average time to foreclose decreases annually for first time in report history

Properties foreclosed in Q3 2016 took an average of 625 days to complete foreclosure – 1,038 days in Florida – down from 631 days in the previous quarter and 630 days a year ago. It's the first decrease since ATTOM began tracking average foreclosure timelines in Q1 2007.

Still, Florida remains one of the top 5 for states for long foreclosure timelines ranking fourth behind No. 1 New Jersey (1,262 days), followed by Hawaii (1,241 days) and New York (1,070 days). At No. 5, it takes 942 days in Illinois (942 days).

"The decrease in the average foreclosure timeline indicates that banks have worked through the bulk of the legacy foreclosure backlog in most states – with a few lingering exceptions – and that most of the foreclosures being completed now are relatively recent defaults that are more efficiently progressing through the foreclosure pipeline," Blomquist says.

Florida foreclosure rates

While the Sunshine State remains in the top 5 nationally for foreclosure rates, it dropped from its historical ranking in one of the top two spots to fifth in ATTOM's latest survey. Nationwide, the top state foreclosure rates are: Delaware (one in every 680 housing units with a foreclosure filing), New Jersey (one in every 691), Nevada (one in every 897), Illinois (one in every 946) and Florida (one in every 950).

In a look at large metro areas with over 200,000 residents, two Florida cities make the top 5. Ranking fourth and fifth, respectively, are Tampa-St. Petersburg (one in every 710 homes) and Jacksonville (one in every 722). Atlantic City; Rockford, Ill.; and Columbia, S.C. had the highest metro foreclosure rates in September.

Other metro areas with high September foreclosure rates include Medford, Oregon (one in every 742 housing units); Lakeland-Winter Haven (one in every 755); Chicago (one in every 767); Philadelphia (one in every 771); and Bakersfield, California (one in every 778).

An interactive map with foreclosure statistics by Florida county is posted on ATTOM's website.

National foreclosures

September foreclosure starts drop to a more than 11-year low, and September bank repossessions decrease 32 percent year-to-year. Overall, investors and, specifically, institutional investors had an increase in activity:

- Third-party investors bought 44 percent of all properties sold at foreclosure auction in the third quarter, with the remaining 56 percent transferring back to the foreclosing lender at the auction.

- The 44 percent sold to third-party investors was the highest share going back as far as Q1 2000 – the earliest data is available – and well above the pre-recession peak of 30 percent in Q2 2005.

- Of the properties sold to third-party investors at the foreclosure auction in Q3 2016, 38 percent were sold to institutional investors, defined as entities purchasing at least 10 properties in a calendar year. That was up from 32 percent in the previous quarter and 26 percent a year ago but still below the peak of 70 percent in Q2 2009.

Monday, October 10, 2016

Let's Talk... Did you know!

Bed, Bath and Beyond might be getting rid of 20 percent off coupons

According to the Wall Street Journal, retailer Bed, Bath and Beyond may stop sending out their popular blue and white 20 percent off coupons and replace them with a membership model. The program could allow shopers to pay $29 a year for 20 percent off all purchases plus free shipping.

Go to the Today Show to see more.

Friday, October 7, 2016

Let's Talk…

| ||

Let's Talk... It's a Fantastic Time to Buy in South West Florida!

Trust me you don't want to miss out on your opportunity!

Closed Sales...The median closed price for condominiums in this entry-level price category was $193,000. August also saw a 50 percent increase in inventory for condominiums in the $300,000 and below price category to 974 condominiums in August 2016 from 648 condominiums in August 2015.

New Listings/Inventory...Overall activity of properties in the $2 million and above price category failed to perform as well in August compared to other price categories. However, condominium inventory in this luxury segment of the market increased 84 percent to 81 condominiums in August 2016 from 44 condominiums in August 2015, while its overall median closed price fell 19 percent (year over year) to $2,537,000 in August 2016 from $3,132,000 in August 2015. This behavior of increased inventory and lower prices primes the luxury segment of the market for a season where the number of properties priced right can certainly meet demand.Overall inventory increased 36 percent for the second month in a row to 4,787 homes in August 2016 from 3,525 homes in August 2015. In fact, while inventory rose in all price categories for both home types, the overall median closed price remained flat in August, with the exception of homes in the $300,000 and below price category, which increased 9 percent to $210,000 in August 2016 from $192,000 in August 2015.

Average & Median Sales Price...The median closed price for condominiums in this entry-level price category was $193,000. August also saw a 50 percent increase in inventory for condominiums in the $300,000 and below price category to 974 condominiums in August 2016 from 648 condominiums in August 2015.

NABOR® broker analysts suspect some potential buyers of high-end properties may be reluctant to make big financial decisions because of the uncertainty of the economy after the Presidential election. However, as the report indicated, activity in this segment of the market is historically lower than it is during seasonal months. Brokers were quick to point out that this tapering is anticipated during the summer and expect sales in this segment to rise as we move into the next season.

Full Market Report for your review below.

Please feel free to contact me with any questions you may have by

contacting me by e-mail at Michelle@NaplesHomeSweetHome.com

or by calling 239.404.7787.

Southwest Florida Happenings:

| ||

Summer Activity Indicates Promising Season

| ||

The housing market’s momentum continues to remain strong heading into fall. Upon reviewing the August 2016 Market Report released by the Naples Area Board of REALTORS® (NABOR®), broker analysts cited several reasons why buyers and sellers can expect a promising winter season such as the inventory is continuing to increase and the median closed prices are remaining virtually unchanged.

Overall activity of properties in the $2 million and above price category failed to perform as well in August compared to other price categories. However, condominium inventory in this luxury segment of the market increased 84 percent to 81 condominiums in August 2016 from 44 condominiums in August 2015, while its overall median closed price fell 19 percent (year over year) to $2,537,000 in August 2016 from $3,132,000 in August 2015. This behavior of increased inventory and lower prices primes the luxury segment of the market for a season where the number of properties priced right can certainly meet demand. | ||

Real Estate Tidbits

| ||

| ||

Around Naples

| ||

Don't forget .... Turn Back Your Clocks!!!

November 6th

Michelle's Food Picks of the Month for the Naples area!!!

Thai Ubon Cafe 5th Avenue...

Fresh off of the success of our first restaurant, Thai Udon Cafe has created a beautiful new space on Naples' famous 5th Avenue, just 3 blocks from the Gulf of Mexico.

While we continue to serve a full complement of traditional and modern Thai and Japanese fare, we now offer a wide variety of a la carte sushi (nigiri) and scrumptious, unique maki rolls.

Enjoy meals inside or outside of the folding Euro doors accompanied by your choice of wine, sake, or draft and bottled beers.

******************************************

Jimmy P's Charred...

For generations, the men of the Pepper family have labored to become masters of all things meat. The knife of Jim Sr. has carved nearly 3 million cuts of meats, and the Pepper family's secret recipes for spice mixtures, techniques, sauces and smokehouse favorites have been guarded for more than three quarters of a century. When Jimmy Pepper Jr, came to the block, he left the cleaver to his dad and headed into the office. Jimmy crafted crowd pleasing menu items utilizing the finest products that his dad was producing and put together the business plan that has led to continuous growth and expansion for Jimmy P's Butcher Shop and Deli. The lunch business at Jimmy P's is bursting at the seams, so more space and the addition of dinner hours is how they plan to meet and exceed the expectations of their customers.

Staying true to who they are, “Charred”, the butcher shop's dining area, will serve the finest quality meats, expertly cut or smoked by Jim Sr. and his team. “We hope that our guests will enjoy the unique and exclusive opportunity of watching their personally selected, hand cut Wagyu steak traveling from the butcher block to the grill.”

******************************************

Pizza Fusion is a new take on America’s favorite food. We proudly serve up delicious, gourmet pizza in its purest form - untainted by artificial additives, like preservatives, growth hormones, pesticides, nitrates and trans fats (to name a few). While we’re famous for our pizza, our 75% organic menu features an eclectic variety of gourmet sandwiches, salads, desserts, beer and wine. Additionally, we proudly offer health conscious alternatives for our friends with selective diets and food allergies, such as our delicious gluten-free pizza, brownies and beer and our tasty vegan selections.

Born from a desire to make a difference, every detail of our operations is continuously evaluated from an environmental perspective in an effort to further minimize our ecological footprint. From delivering our food in company owned hybrid vehicles and offsetting 100% of our power consumption with the purchase of renewable wind energy certificates to building restaurants to LEED certified standards, we are committed to being a leader in not only the pizza industry, but in a better quality of life. Through our spirited philosophy and principled leadership, Pizza Fusion will redefine the fast casual restaurant industry.

******************************************

Mercato...

Anchored by Whole Foods Market, Nordstrom Rack and Silverspot Cinema, a 12-screen premier-style theater, Mercato offers 12 notable restaurants, over 20 upscale retailers and luxury residential condominiums. Mercato hosts a vibrant year-round event calendar with most events free and open to the public.

******************************************

| ||

My Featured Listings...

| ||

| ||

Royal Harbor | Boating Community

| ||

| ||

Castillo at Tiburon | Resort Style Development

| ||

| ||

Castillo at Tiburon | Resort Style Development

| ||

| ||

Aviano | Small Enclave Community

| ||

| ||

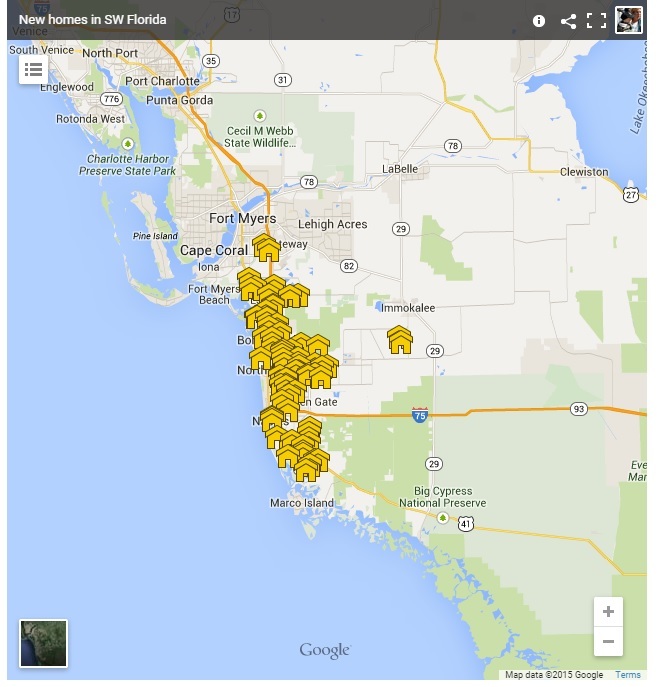

Naples New Construction!

| ||

| ||

Dining in Naples:

| ||

| ||

Events Around Naples!

| ||

| ||

Subscribe to:

Posts (Atom)